Article 114 of the Indian Constitution addresses the significance of Appropriation Bills within the legislative framework. Appropriation Bills are fundamental to the governance process as they provide the legal authority for the government to withdraw funds from the Consolidated Fund of India to meet the approved expenditures outlined in the annual financial statement, commonly known as the Budget.

What does Article 114 states ?

Appropriation Bills

(1) As soon as may be after the grants under article 113 have been made by the House of the People, there shall be introduced a Bill to provide for the appropriation out of the Consolidated Fund of India of all moneys required to meet

(a) the grants so made by the House of the People; and

(b) the expenditure charged on the Consolidated fund of India but not exceeding in any case the amount shown in the statement previously laid before Parliament

(2) No amendment shall be proposed to any such Bill in either House of Parliament which will have the effect of varying the amount or altering the destination of any grant so made or of varying the amount of any expenditure charged on the Consolidated Fund of India, and the decision of the person presiding as to whether an amendment is inadmissible under this clause shall be final

(3) Subject to the provisions of articles 115 and 116, no money shall be withdrawn from the Consolidated Fund of India expect under appropriation made by law passed in accordance with the provisions of this article

Clauses of Article 114

Clause(1) :-

- According to the first provision of Article 114 inside the Indian Constitution, it is stated that

(1) A legislative proposal would be presented to allocate funds from the Consolidated Fund of India to fulfill awards awarded under Article 113, after the Lok Sabha has provided its approval. The individuals will be introduced in order to fulfill the necessary criteria.

(a) The allocations in question, which are made by the Lok Sabha,

(b) The expense that is charged to the Consolidated Fund of India should not beyond the amount stated in the financial statement submitted to Parliament.

Clause(2) :-

- According to the second clause of Article 114 of the Indian Constitution, it is stipulated that no modification shall be presented in either the Lok Sabha or the Rajya Sabha that would alter the predetermined sum to be withdrawn from the Consolidated Fund of India.

- The grant amount should be consistent with the figure reported in the previously presented financial statement. In the event that an amendment is necessary, the individual presiding over the proceedings, who may hold the position of Speaker or Deputy Speaker of the Lok Sabha, would have discretion in determining the acceptance or rejection of the amendment.

Clause(3) :-

- According to the provisions outlined in Article 114 of the Indian Constitution, the third clause stipulates that the withdrawal of funds from the Consolidated Fund of India is contingent upon the passage of an appropriation bill in the House of People, as specified in Articles 115 and 116 of the Indian Constitution.

What is an Appropriation Bill ?

- The Appropriation Bill confers authority upon the government to access monies from the Consolidated Fund of India in order to fulfill spending requirements during the fiscal year.

- According to Article 114 of the Constitution, the withdrawal of funds from the Consolidated Fund by the government is contingent upon obtaining parliamentary consent.

- The funds that are withdrawn are utilized to fulfill the immediate financial obligations during the fiscal year.

Key attributes of Appropriation Bill

| Feature | Description |

|---|---|

| Purpose | Authorizes government to withdraw funds from Consolidated Fund for specified expenditures. |

| Budget Implementation | Translates proposed expenditures from the annual financial statement (Budget) into actual spending. |

| Specific Allocation | Designates amounts for ministries, departments, programs, and purposes outlined in the Budget. |

| Legal Authorization | Upon passage and Presidential assent, becomes law, empowering government to use approved funds. |

| Government Accountability | Ensures adherence to approved expenditures, promoting transparency and resource utilization. |

| Itemized Breakdown | Provides categorized breakdown of expenses, including Revenue and Capital Expenditure. |

| Scope of Expenditure | Covers all government costs, including salaries, projects, administrative expenses, debt repayment, etc. |

| Limited Withdrawals | Allows funds withdrawal only as authorized by the Bill, requiring supplementary Bills for additional spending. |

| Contingency Provisions | Permits approval for unforeseen expenses through supplementary or additional Appropriation Bills. |

| Parliamentary Oversight | Subjected to detailed debates and discussions in both houses, enabling comprehensive review. |

| Annual Renewal | Introduced and passed for each fiscal year, ensuring government operates within approved expenses. |

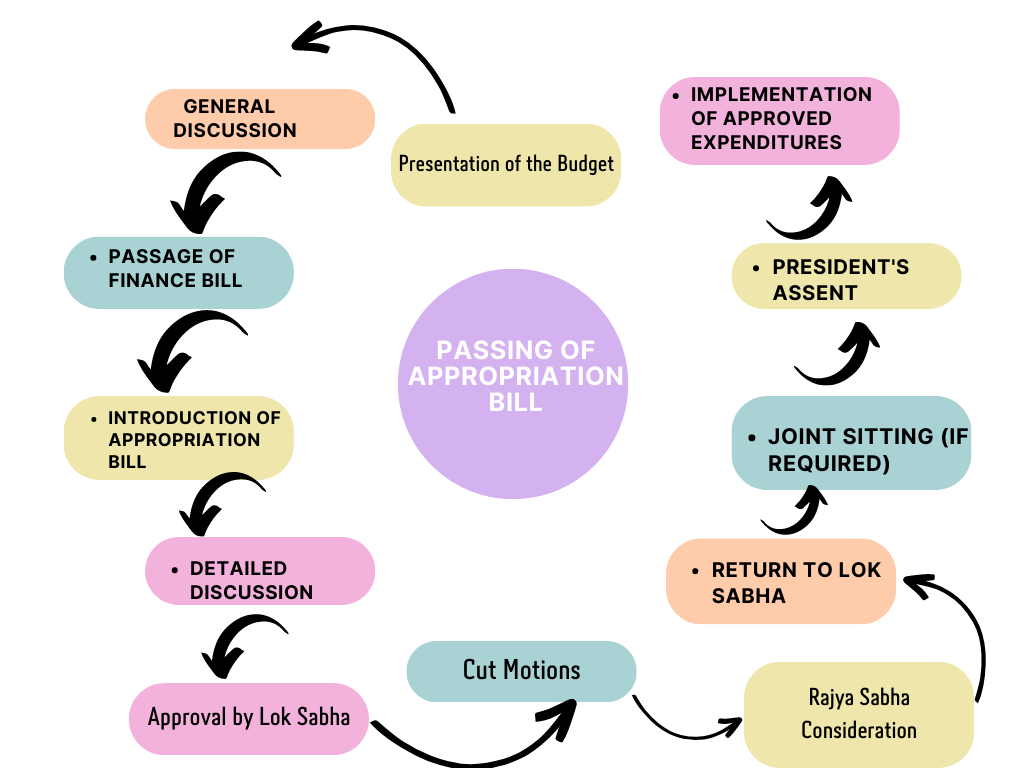

Procedure for passing an Appropriation Bill

- Presentation of the Budget: The process begins with the presentation of the annual financial statement (Budget) by the Finance Minister in the Lok Sabha (House of the People). This includes the estimates of revenue and expenditures for the upcoming fiscal year.

- General Discussion: After the Budget presentation, a general discussion takes place in the Lok Sabha where Members of Parliament (MPs) can express their views on the government’s financial proposals.

- Passage of Finance Bill: Before discussing the Appropriation Bill, the Finance Bill is usually passed. The Finance Bill includes taxation and financial policies associated with the Budget.

- Introduction of Appropriation Bill: Once the Finance Bill is passed, the Appropriation Bill is introduced. It specifies the allocation of funds from the Consolidated Fund for various purposes as outlined in the Budget.

- Detailed Discussion: The Appropriation Bill is subjected to detailed clause-by-clause discussion in the Lok Sabha. MPs can propose amendments to the allocations and expenditures during this stage.

- Cut Motions: MPs can also move “cut motions” to reduce the amounts allocated for certain expenditures. These motions provide an opportunity for MPs to express their disapproval of specific allocations.

- Approval by Lok Sabha: After the discussion and amendments, the Appropriation Bill is put to vote in the Lok Sabha. If the Bill is approved, it moves to the Rajya Sabha (Council of States).

- Rajya Sabha Consideration: In the Rajya Sabha, the Appropriation Bill goes through a similar process of discussion, possible amendments, and voting.

- Return to Lok Sabha: If the Rajya Sabha makes any amendments to the Bill, it is sent back to the Lok Sabha for consideration of those amendments.

- Joint Sitting (if required): In case of a deadlock between the two houses regarding the amendments, a joint sitting of both houses can be convened to resolve the issue.

- President’s Assent: Once both houses agree on the final version of the Bill, it is sent to the President of India for assent. The President‘s assent transforms the Bill into law.

- Implementation of Approved Expenditures: After receiving the President’s assent, the government can utilize the funds allocated in the Appropriation Bill for the specified expenditures during the fiscal year.