Article 205 of the Indian Constitution addresses the procedures for supplementary, additional, or excess grants. This article delineates the authority and responsibilities of the Governor in cases where the initially allocated funds for a particular service or expenditure are found to be inadequate or when unforeseen financial requirements arise during the ongoing financial year.

What does Article 205 states ?

Supplementary, additional or excess grants

(1) The Governor shall

(a) if the amount authorised by any law made in accordance with the provisions of article 204 to be expended for a particular service for the current financial year is found to be insufficient for the purposes of that year or when a need has arisen during the current financial year for supplementary or additional expenditure upon some new service not contemplated in the annual financial statement for that year, or

(b) if any money has been spent on any service during a financial year in excess of the amount granted for that service and for that year, cause to be laid before the House or the Houses of the Legislature of the State another statement showing the estimated amount of that expenditure or cause to be presented to the Legislative Assembly of the State a demand for such excess, as the case may be

(2) The provisions of articles 202, 203 and 204 shall have effect in relation to any such statement and expenditure or demand and also to any law to be made authorising the appropriation of moneys out of the Consolidated Fund of the State to meet such expenditure or the grant in respect of such demand as they have effect in relation to the annual financial statement and the expenditure mentioned therein or to a demand for a grant and the law to be made for the authorisation of appropriation of moneys out of the Consolidated Fund of the State to meet such expenditure or grant.

Clauses of Article 205

Clause(1) :-

- The initial provision of Article 205 of the Indian Constitution delineates the obligations of the Governor pertaining to fiscal administration within a state. The Governor bears the duty of apprising the Legislature of any unforeseen or supplementary fiscal requirements that may emerge throughout the course of a given fiscal year.

- In cases where the allocated funds for a State’s specific service are inadequate for the given fiscal year, or if there arises a necessity for supplementary or additional expenditure on a new service that was not initially accounted for in the annual financial statement, it is obligatory to submit a statement to the Legislature outlining the projected amount of this supplementary expenditure.

- In a same vein, in the event that funds have been expended beyond the allocated amount for a certain purpose during a given fiscal year, it is incumbent upon the Governor to formally request the surplus amount from the Legislative Assembly.

Clause(2) :-

- The subsequent phrase of Article 205 inside the Indian Constitution elucidates that the regulations outlined in articles 202, 203, and 204, pertaining to the annual financial statement and the corresponding expenditure, shall similarly be applicable in such situations.

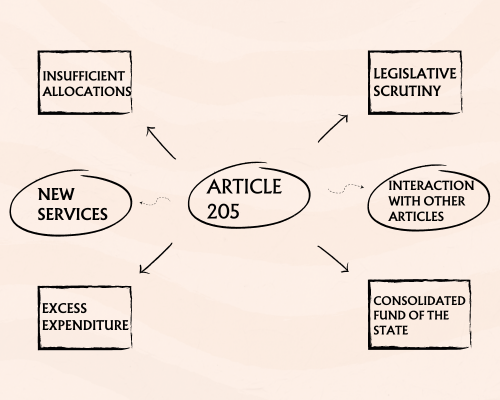

Key Aspects of Article 205

- Insufficient Allocations: If the amount authorized by a law made in accordance with Article 204 (which deals with Appropriation Bills) is found to be inadequate for a particular service during the current financial year, Article 205 empowers the Governor to take action. In such cases, the Governor can present a statement before the State Legislature showing the necessity for supplementary or additional expenditures on that service.

- New Services: Additionally, if during the ongoing financial year, the need arises for expenditure on a new service that was not originally included in the annual financial statement, the Governor can bring this matter before the State Legislature as well. This ensures that new financial requirements, unforeseen at the time of budget planning, are appropriately addressed through a parliamentary process.

- Excess Expenditure: Moreover, if any money has been spent on a particular service during a financial year in excess of the amount initially granted for that service and for that year, Article 205 requires the Governor to present another statement before the State Legislature. This statement should estimate the amount of the excess expenditure and provide explanations for the overexpenditure.

- Legislative Scrutiny: The presentation of statements or demands under Article 205 triggers a process of legislative scrutiny. The State Legislature, through its members, reviews the situation, debates the necessity of the additional or excess expenditure, and ensures that public funds are utilized effectively and efficiently. This allows for transparency and accountability in financial matters.

- Interaction with Other Articles: Article 205 references Articles 202, 203, and 204 of the Constitution. Articles 202 and 203 deal with the procedure for the annual financial statement and demands for grants, respectively. Article 204 pertains to Appropriation Bills. Article 205 effectively extends the principles of these articles to situations involving supplementary, additional, or excess grants.

- Consolidated Fund of the State: Similar to the federal government’s Consolidated Fund of India, each state has a Consolidated Fund of the State where all revenues received by the government are credited, and from which all expenditures are made. Article 205 ensures that any additional or excess expenditures are authorized and funded from this consolidated fund, maintaining financial discipline.